Watts Working

Demand Response Auctions and Ohio Utility Successes: What a Week at World Energy

Dan Mees | March 2, 2012 at 11:47 am

It has been quite a week for us, and I wanted to provide a little color on it. Yesterday, we announced our first demand response auction for the General Services Administration, one of the largest building owners in North America and our largest and longest-standing customer.

It has been quite a week for us, and I wanted to provide a little color on it. Yesterday, we announced our first demand response auction for the General Services Administration, one of the largest building owners in North America and our largest and longest-standing customer.

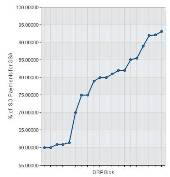

The auctions we ran were the culmination of a strong collaboration with both the GSA Energy Division and SAIC. The auctions netted the participants, GSA and the Dept. of Veterans Affairs, an average revenue split of 91.8%, up from 75.5%, for an expected payout of ~$1.5 million over the next three years. The screenshot we featured in the press release speaks volumes about how a fair and transparent online auction process can yield a superior result to the old way of brokering demand response. Not only were the GSA and VA pleased with the outcome, but industry watcher Wedbush Securities saw in the process and its results a clear sign of the “accelerating commoditization of first generation demand response products.”

We also cheered the results of Dominion East Ohio’s (DEO) combined standard choice offer (SCO) and standard service offer (SSO) auction, which attracted 16 suppliers and established a new retail price adjustment of 60 cents per thousand cubic feet, a decrease of 40 cents from the existing price adjustment. You don’t have to be a math major or energy expert to guess at the impact of such a decrease: lower prices for customers. The DEO auction capped off an annual “trifecta” of Ohio utility auctions World Energy has successfully run for the last several years, including DEO, Columbia Gas of Ohio and Vectren Energy Delivery of Ohio. Each of this year’s auctions yielded great results that were approved by the Public Utility Commission of Ohio, extending World Energy’s perfect record of rate case approvals.

Twitter

Twitter

LinkedIn

LinkedIn

RSS Feed

RSS Feed