Watts Working

Natural Gas: A Volatile Reminder

Dave Laipple | June 29, 2011 at 10:38 am

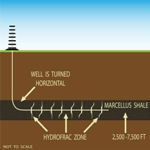

The natural gas industry and, more specifically, the news around factors influencing the price of the commodity, continue to be all over the board. Pricing levels hit previous 5-7 year lows during 2009 and, aside from a couple of spikes in late ’09 and early ’10, have remained relatively low. News about significant volumes of natural gas trapped in deep underground shale formations has been a driver in impacting supply outlooks. At various points in time, some industry veterans have even gone so far as to predict that the Marcellus shale in the Appalachian basin could provide much of the future needs for the Northeastern U.S.

The natural gas industry and, more specifically, the news around factors influencing the price of the commodity, continue to be all over the board. Pricing levels hit previous 5-7 year lows during 2009 and, aside from a couple of spikes in late ’09 and early ’10, have remained relatively low. News about significant volumes of natural gas trapped in deep underground shale formations has been a driver in impacting supply outlooks. At various points in time, some industry veterans have even gone so far as to predict that the Marcellus shale in the Appalachian basin could provide much of the future needs for the Northeastern U.S.

Now, however, we have people voicing skepticism about the shale gas industry. In a NY Times article this past weekend, uncertainties about how long shale wells will be productive and higher than expected costs were reported. This is in addition to the environmental concerns that have already been expressed on a regular basis. Volatility is the constant in this industry, and these recent revelations serve as a good reminder that natural gas consumers need to stay vigilant and be smart, making sure they manage risk in a way that helps them meet their stated goals and objectives. Stay tuned as the adventure continues!

Twitter

Twitter

LinkedIn

LinkedIn

RSS Feed

RSS Feed